Investing in the Yoshino EXB1 and B4000 SST system could qualify you for the Federal Solar Tax Credit. Follow these simple steps to make the most of this opportunity and reduce your upfront costs.

1. Confirm Eligibility

To qualify for the tax credit, verify that your Yoshino system purchase meets these requirements under the IRS guidelines for clean energy property tax credits:

- Storage Capacity: Your battery must have a minimum storage capacity of 3kWh—which the EXB1 easily surpasses by adding an additional 2,562Wh on top of the 2,611Wh supplied by the B4000 (5.1kWh total).

- Primary or Secondary Home: Install the system at your primary or secondary residence in the U.S. (Sorry, rentals don’t qualify unless you own the system!)

- New Purchase Requirement: The equipment must be new and purchased for the first time. Refurbished systems are not eligible.

The US Department of Energy may also offer certain tax incentives to corporations to assist in financing projects deemed beneficial to the public. For more information, visit their website here.

2. Purchase & Install Your Solar-Driven Power System

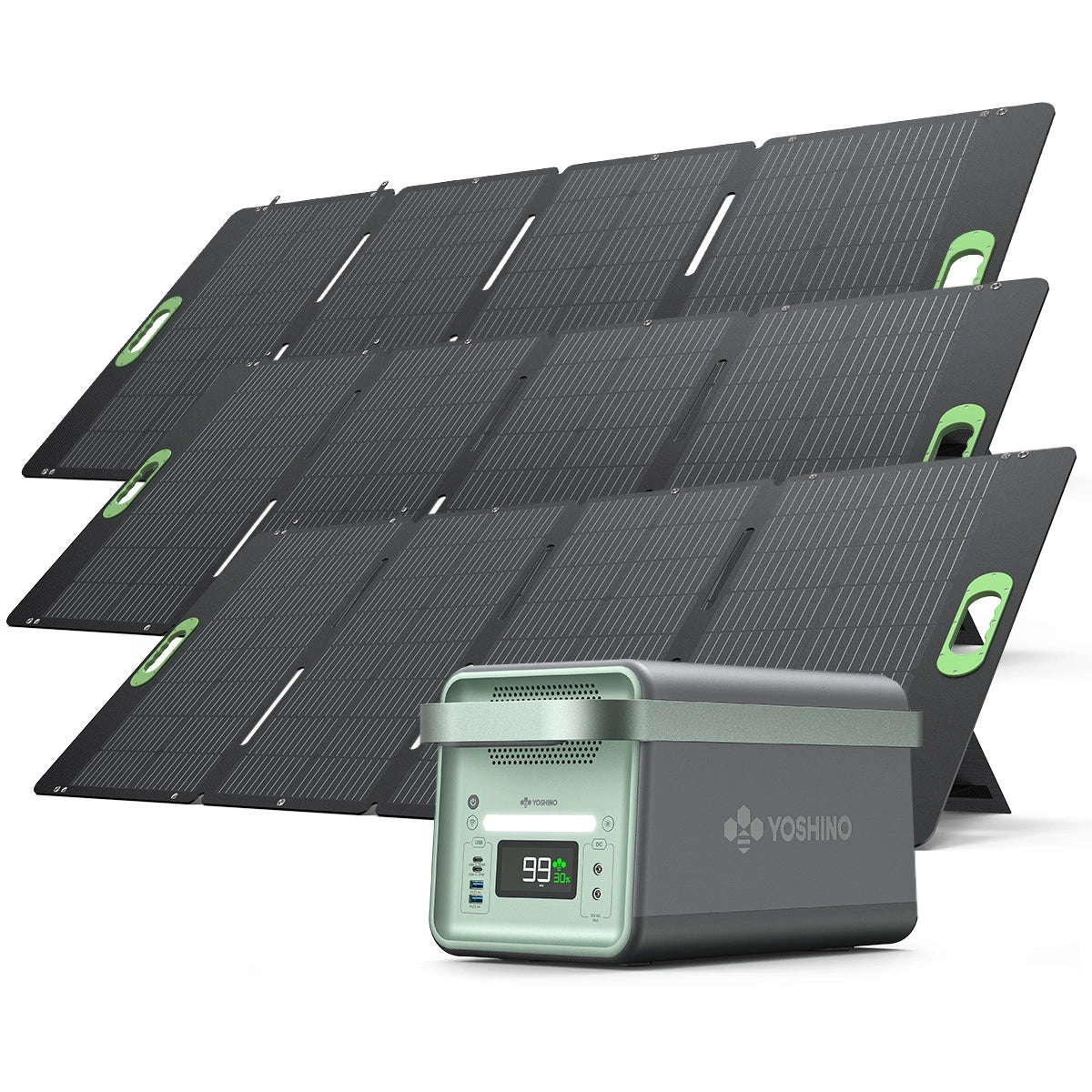

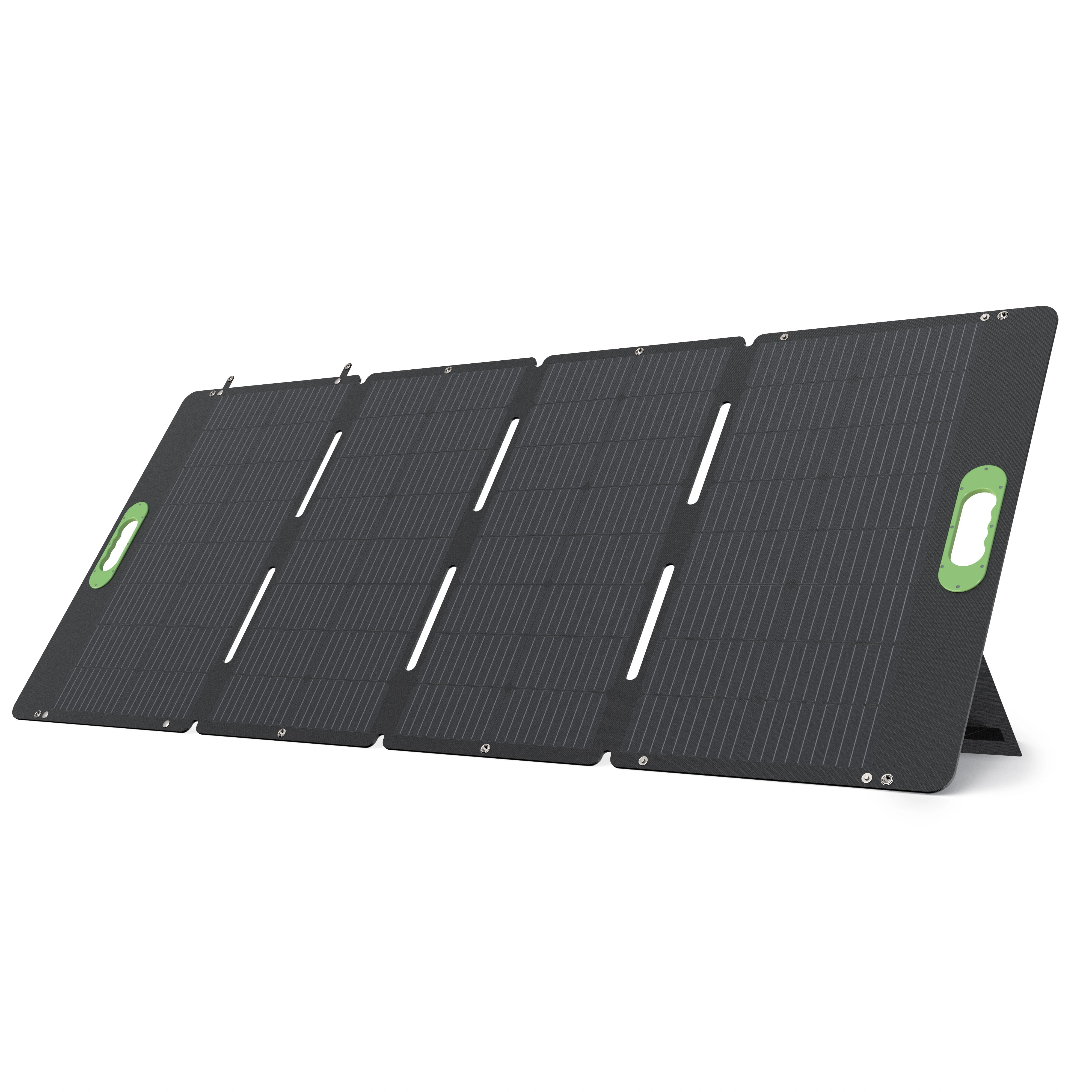

Combine your Yoshino B4000 SST power station with compatible solar panels to create a clean, renewable energy solution that generates and stores electricity for your home. The EXB1 Expansion Battery not only boosts capacity but also adds 1,200W of solar input (EXB1 battery only, 600W max on the B4000), ensuring optimal energy efficiency at all times.

To maximize your solar setup’s benefits, choose panels and systems that comply with Federal Solar Tax Credit stipulations. Need help? The Yoshino team is just a call away.

3. Keep Your Receipts and Documentation

You’ll need proof of purchase to claim the clean energy tax credits. Retain receipts, invoices, or contracts detailing the costs associated with your Yoshino system purchase and solar panel installation. Ensure each document includes labor charges, permitting fees, and any additional expenses related to connecting your system.

4. File IRS Form 5695

Come tax season, complete IRS Form 5695 (Residential Energy Credits) to claim your credit. On line 1 of the form, enter the total costs spent on eligible energy equipment, which includes the Yoshino system and its associated installations. For example:

- System Cost (Yoshino B4000 SST + Yoshino EXB1 + Solar Panels): $9,000

- Tax Deduction (30% of $9,000): $2,700

When filing your tax return (Form 1040), transfer the credit amount from Form 5695. If using software like TurboTax, simply input your costs—you’ll receive automatic calculations and guidance.

5. Apply for Any State or Local Incentives

Some states offer additional credits or rebates for clean energy systems. Do your research or speak with a tax professional to ensure you maximize all available benefits. Incentives like net metering (which compensates you for excess energy sent to the grid) can further boost your savings. California, Florida, and Texas are just some examples of states that offer additional incentive programs.